Coming Soon! Subscribe here for updates and more info to #BuildWithOmni

-

Important Update: Shop legacy sales are closed but will support ytp 4.2+ and Joomla 5

Setting up Countries & Zone Taxes

Countries control taxes so it's important to check these settings prior to store launch.

-

You're going to want to Global Configuration and check if the parameters there are set up as required for your use case.

-

See Global Configurations overview

-

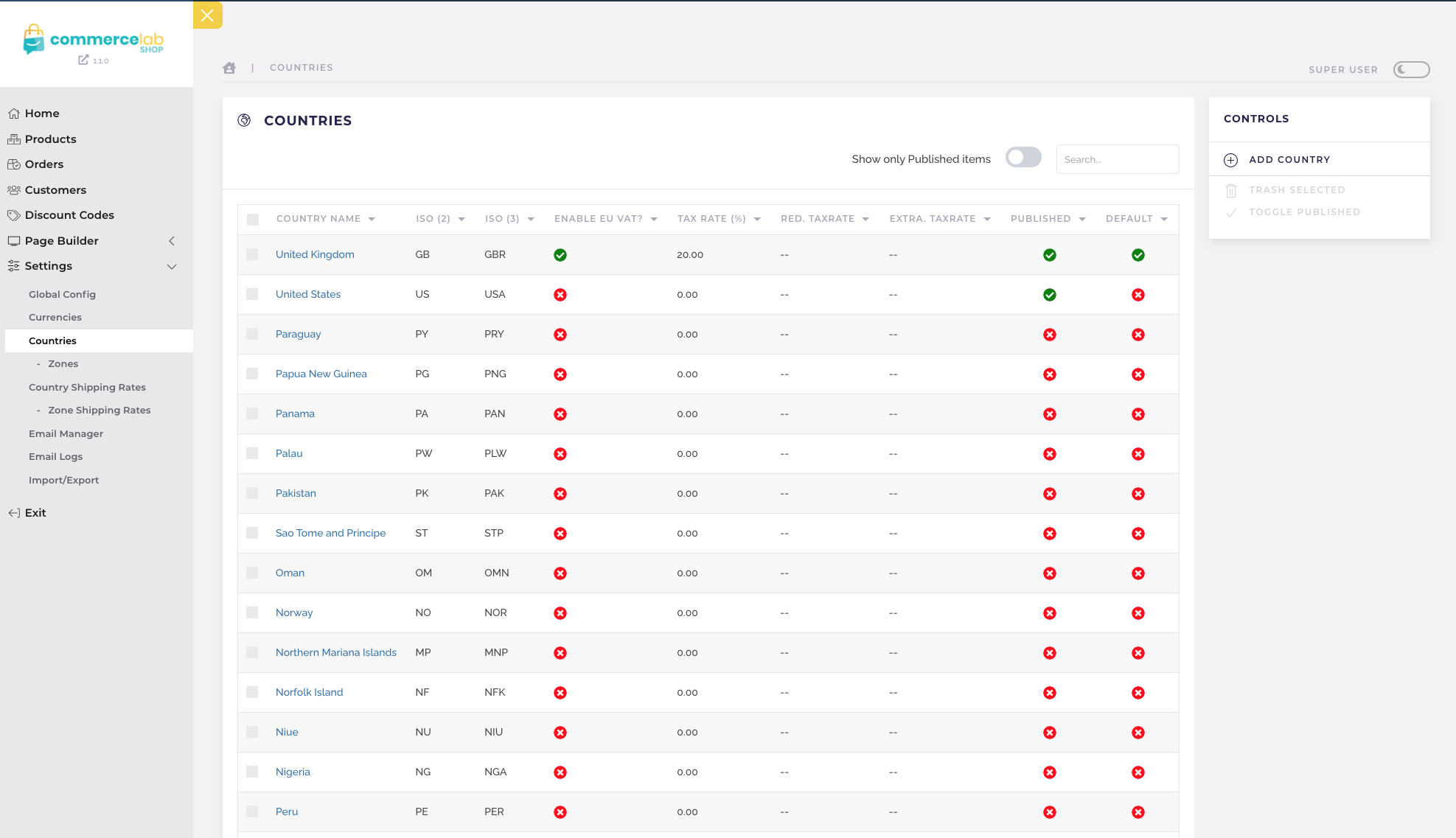

Navigate to your Countries by going to the CommerceLab Shop dashboard then scroll down and active the settings dropdown where you will see the countries "Countries"link. Click that.

-

Here is a list of all countries you can add a new country or activate them by clicking the red dots as well as change your default.

-

Note: We recommend re-saving your default country after install, just click into it and re-save to ensure it's working properly.

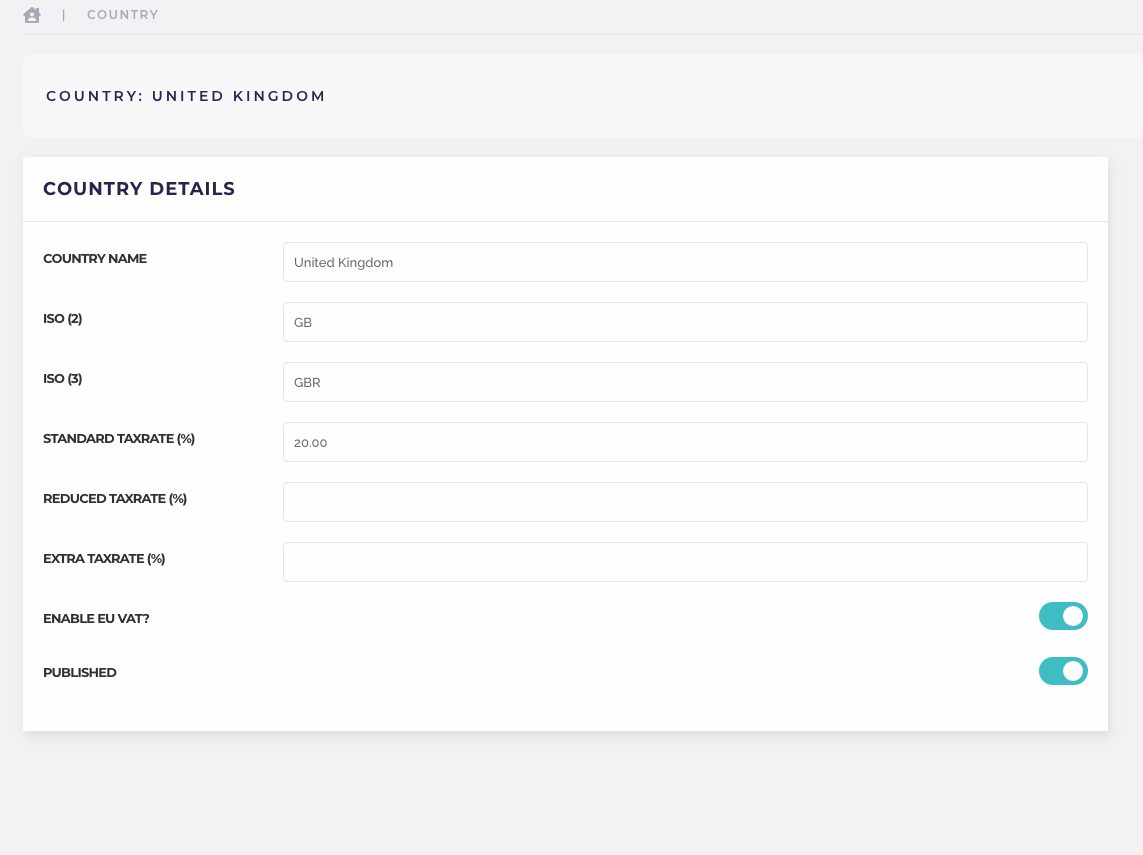

Country options, tax rates

-

We've gone far into taxes per country to be in accordance with the new laws emerging. you can add "standard rate" "Reduced Tax Rate" "Extra Tax Rate" All equated to checkout which you assign in yto your product when being created.

-

EU VAT comes predefined with CommerceLab Shop via API if you enable it it will calculate for products.

Country "Zones"

-

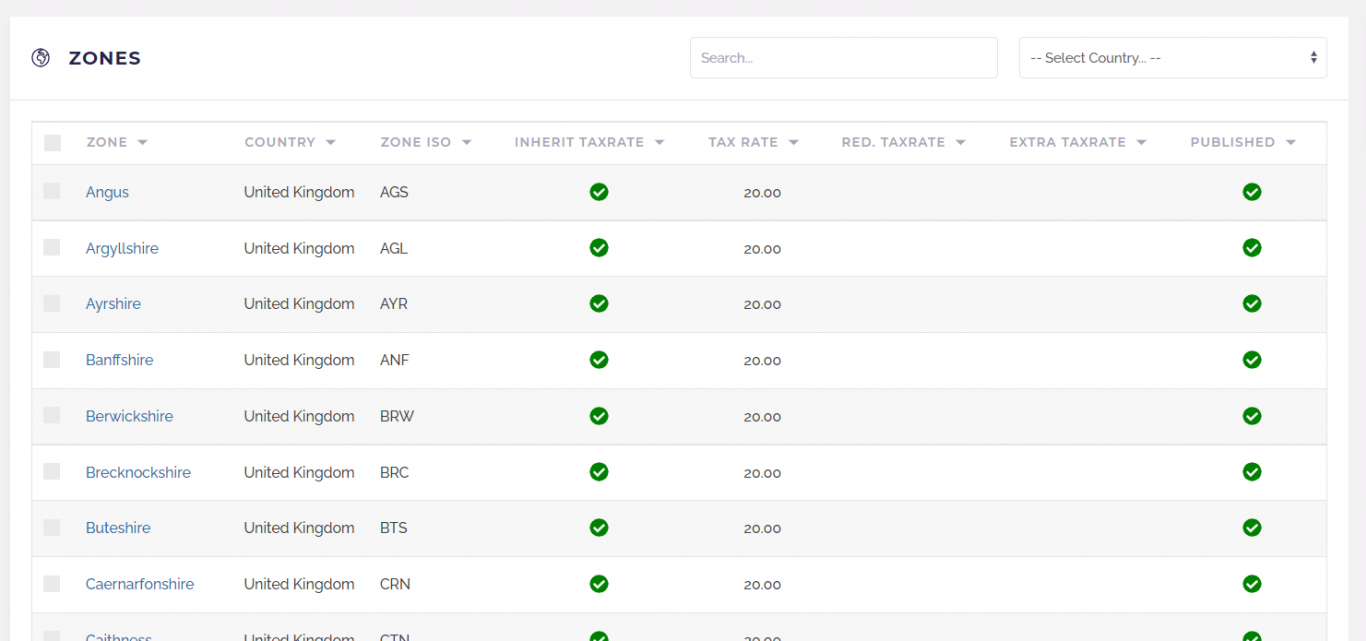

Zones are directly below the countries tab in the sidebar of your CommerceLab Shop sidebar in the settings area.

-

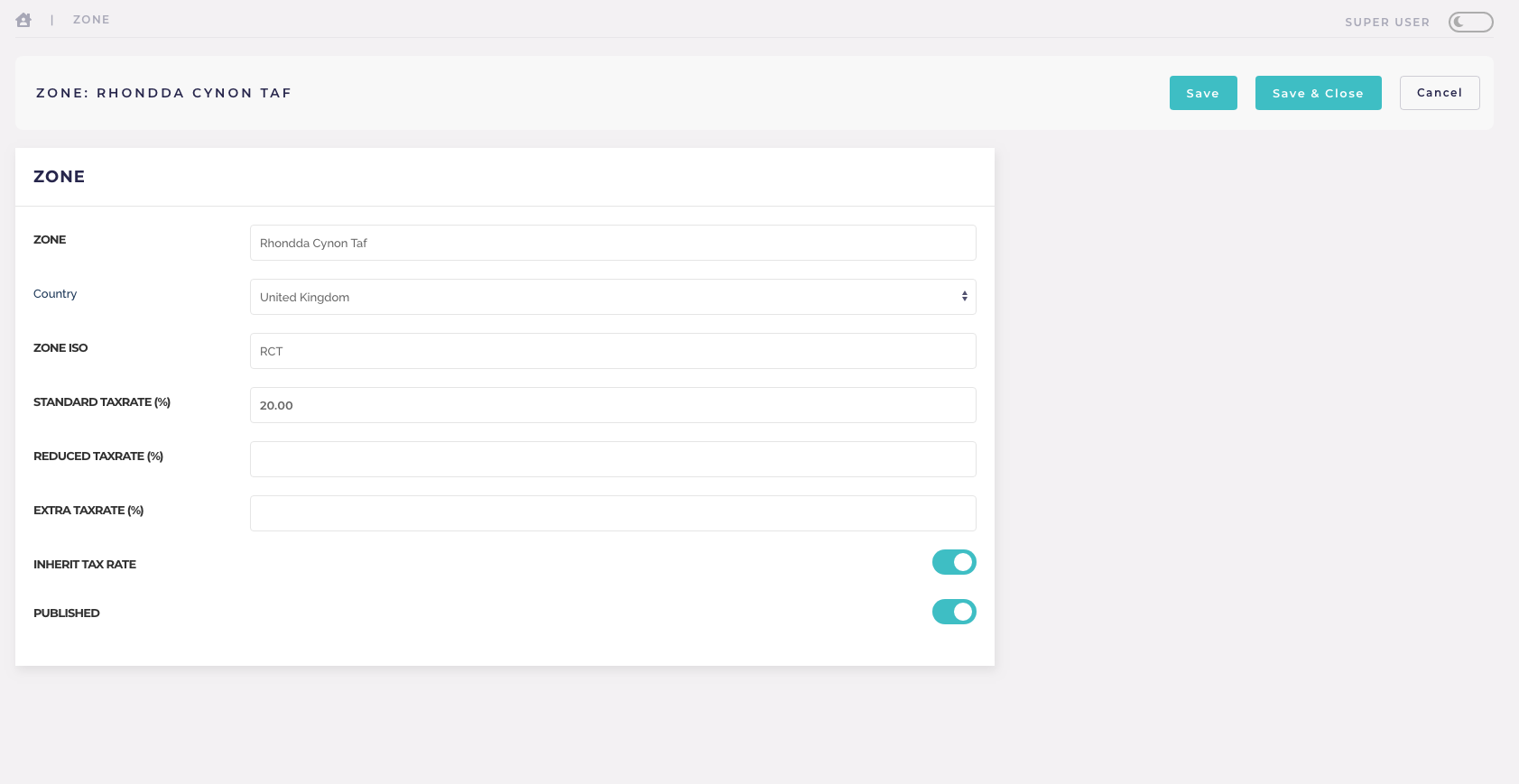

If you are taxing your products based on the customer's address, beside the countries where you are shipping be sure to set the tax rates for each zone (state) within the country. By Default, zones inherit the country's tax rate(s), but that can be changed for each zone if required.

-

Rememebr that applying tax happens on a product level. You will define the type of tax that each product will have appplied and that will equate to the final price at checkout.

©

Omni all rights reserved. A CommerceLab Corporation Product.